douglas county nebraska car sales tax

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card. Request a Business Tax Payment Plan.

Worst Case Scenario Weapons Come Through Surplus

LINCOLN Douglas County Treasurer and State DMV Driver Licensing customers will notice some changes the next time they visit the office at 2910 N.

. Make a Payment Only. The Nebraska sales tax rate is currently 55. The minimum combined 2022 sales tax rate for Douglas Nebraska is 55.

The bill of sale must be. Purchase of a 30-day plate by a. Sales Tax Rate Finder.

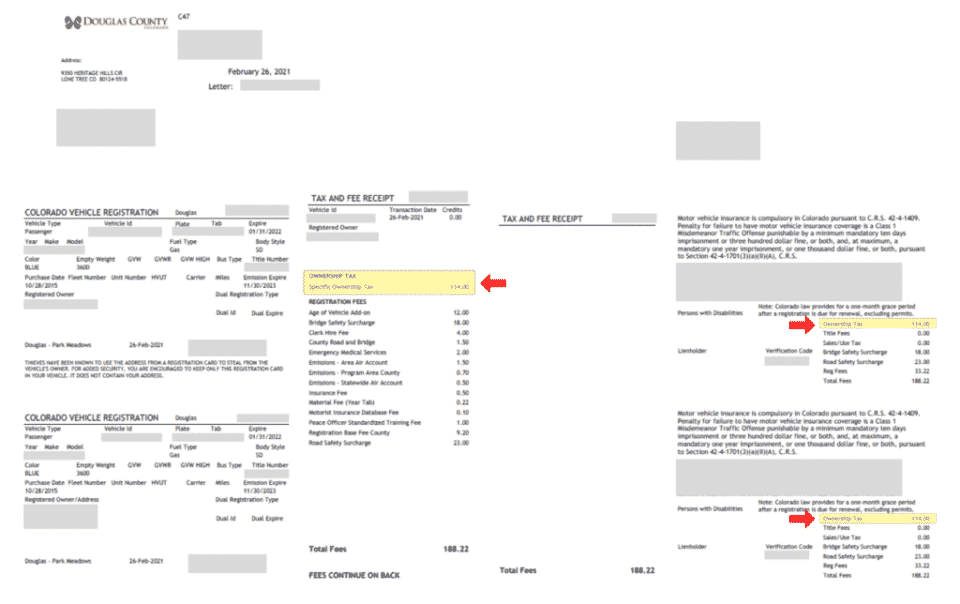

Motor Vehicle Fee is based upon the value weight and use of the vehicle and is adjusted as the vehicle ages. Or Form 6XMB Amended Nebraska Sales and Use Tax Statement for Motorboat Sales. Nebraska has a 55 sales tax and Douglas County collects an additional NA so the minimum sales tax rate in Douglas County is 55 not including any city or special district taxes.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Sales and Use Tax Regulation 1-02202 through 1-02204. As far as all cities towns and locations go the place with the highest sales tax rate is Elkhorn and the place with the lowest sales tax rate is Bennington.

This is the total of state county and city sales tax rates. Sales and Use Tax. What is the sales tax rate in Douglas County.

The County Treasurer then issues a title to the new owner. The Douglas Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Douglas local sales taxesThe local sales tax consists of a 150 city sales tax. 161 rows Name Last Known Address City State Zip County Tax Category Balance ABRAMO JOSEPH C.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. Original or copy of the front and back of the title or a copy of the bill of sale listing the date and time of vehicle sale notarized or signed under penalty of perjury. After 1 is retained by the County Treasurer the distribution of funds collected.

The minimum combined 2022 sales tax rate for Douglas County Nebraska is. This is the total of state and county sales tax rates. The most populous zip code in Douglas.

Form 6MB Nebraska Sales and Use Tax Statement for Motorboat Sales. 2915 NORTH 160TH STREET OMAHA NE 68116 DOUGLAS Sales Tax. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. The Nebraska state sales and use tax rate is 55 055. 10 rows Douglas County Has No County-Level Sales Tax.

Please refer to Certificate of Title for further information regarding the title application process and Vehicle Registrations for. The bill of sale must be. The Nebraska state sales and use tax rate is 55 055.

Vehicle And Boat Registration Renewal Nebraska Dmv

Motor Vehicles Douglas County Treasurer

Douglas County Treasurer S Office

![]()

1 Douglas County Omaha Nebraska Department Of Motor Vehicles

Nebraska Income Tax Calculator Smartasset

Douglas County Treasurer Government Building

News Flash Douglas County Wa Civicengage

Tax Values Are Up Where Are The Biggest Increases In Douglas And Sarpy Counties

Death And Taxes Nebraska S Inheritance Tax

Douglas County Nebraska Facebook

New Dmv Office Now Open In West Omaha Omaha Daily Record

State Elections Officials Struggle With Paper Shortages Harassment Insider Threats Nebraska Examiner

Motor Vehicle Driver License Umbrella Page Douglas County

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

![]()

1 Douglas County Omaha Nebraska Department Of Motor Vehicles

/cloudfront-us-east-1.images.arcpublishing.com/gray/NKBZRF6RXBKERBYPBFA4OAR6RM.jpg)